PAIN POINT: VIRTUAL BANK PROCESSES

- 1. Costly ATM fees

Virtual bank customers may be caught off guard with fees racked up for ATM use. While many traditional banks offer free access to network ATMs, internet bank usually rely on having customers use one or more third-party ATM networks.

- 2. Security breaches

With the advent of credit card frauds and cyber-attacks, people are becoming increasingly concerned with data breaches and the actual security of funds.

INTRODUCING NEW VIRTUAL BANK

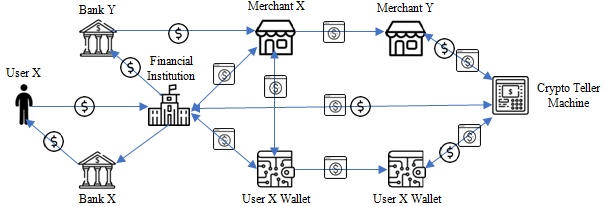

Virtual bank is an internet based financial institution that offers banking facilities through automated teller machines or other devices, without having a physical walk-in premises. New virtual banks are more agile, therefore they have lesser difficulty adopting the decentralized ethos.

OUR SUCCESS STORIESA BVI REGISTERED FINANCIAL INSTITUTION

The blockchain-based virtual banking system provided by Coalculus uses advanced technologies and big data to onboard customers according to stringent international banking standards in KYC/AML/CFT. Our proprietary solution currently explored by bank companies registered in the British Virgin Islands (“BVI”) makes account opening, transfers, deposits and withdrawals a frictionless process in today’s digital world.